Making opportunity out of the slowdown: key steps

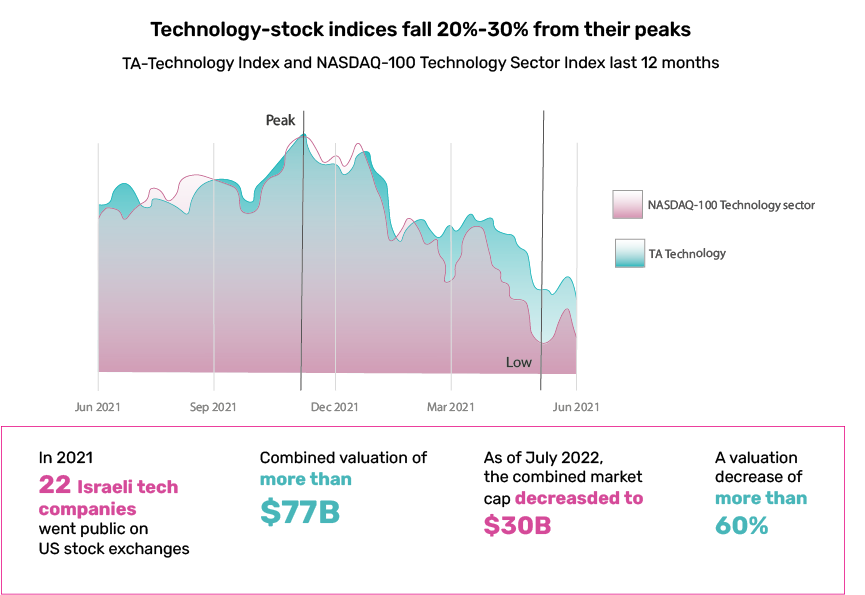

In recent years, the Tech industry’s main focus was on growth. Low interest-rate environment paired with a boost in digital transformation across all industries (especially due to the COVID-19 pandemic) helped the industry achieve record after record.

However, global developments in the past few months are threatening to change that trend. Increased inflation, rising interest rates and geo-political instability are some of the main reasons for the industry’s recent slowdown.

As a result, established companies may suffer revenue declines due to changes in customer demand. Early-stage companies may find that their next funding round is smaller or later than expected. Both must face the new reality and respond quickly and precisely.

Our main message is to focus on their core business and processes and determine what adjustments – and to what extent – should be made.

Both must face the new reality and respond quickly and precisely

1. Cash-flow management

As capital (or debt) raising becomes an effective limitation, the importance of monitoring and planning cash flow is rising dramatically. Although the length and magnitude of the recession is unknown, it would be wise to plan a runway of 24 months based solely on current funds and revenues.

What to do

- Plan ahead – predict runway not only based on current burn rate, but take into account expected changes, as well.

- Build several burn-rate scenarios and monitor them closely. Set scheduled decision points to determine whether additional steps are required to ensure sufficient funds.

- Consider adjusting your proposition to customers to secure revenue in the near future. For example, if your product is a B2C service, consider offering a yearly discounted subscription rather than a monthly-basis offer. If you are a B2B company, focusing efforts on securing a major long-term contract might be more effective than acquiring several short-term contracts.

2. Product-portfolio optimization

Major R&D investment is the main catalyst to ensure long-term growth. Nevertheless, companies need to make sure their resources are invested wisely in developments with a positive ROI. That is especially true when facing a potential recession, a time when short- or mid-term considerations are prioritized.

What to do

- Map your active business lines and current or planned development activities (new products, features, upgrades, etc.)

- Set a bar for minimum revenues/profitability per business line/development activity for the next two years.

- Examine whether each business line meets that criteria. Take into consideration expected demand in those couple of years in light of factors such as market maturity, competition, customer preferences and willingness to pay.

- Consider freezing or adjusting efforts on activities that do not meet the criteria.

Companies need to make sure their resources are invested wisely in developments with a positive ROI, especially when facing a recession

3. Market and segment optimization

Even when not facing a potential slowdown, questions such as: “When is a market significant enough to set up a direct channel?” or, “What is the right and gradual way to expand into new territories?” are key issues for a growing business. In times like these, the questions might be a little different: “Do all the active markets justify the resources invested?” or, “How do we reach potential clients in markets where we don’t have a presence?”

What to do

- Analyze the profitability of each market or segment. Take into account current and expected revenues.

- Consider closing or reducing resources in the least profitable markets or segments by setting solid criteria (for example, “markets that do not have a greater than $1M profit per year” or “the 20% of the least profitable markets”)

- Consider developing alternative distribution channels – direct (e.g., digital channels) or in-direct (e.g., working with local distributers)

4. Work-processes streamlining and regulation

Growth-stage companies are mostly aimed at product-market fit and, therefore, tend to underestimate the meaning of optimal utilization of resources and establishing structured and effective processes. In current times, it is crucial to focus on components such as ambiguous division of responsibility, duplication and involvement of too many stakeholders – all of which ultimately impair optimal organizational functioning.

What to do

- Map the company’s major processes – core processes (e.g., R&D, marketing), supporting processes (e.g., operations, recruiting, onboarding), and managerial processes (e.g., managerial, and organizational routines)

- Identify main processes as focal points for improvement. These processes can be identified easily through data, but also by gathering insights from customers and employees at all levels.

- Outline the desired process flow and compare it with the current one to find gaps in the ways they operate. Then, define suitable actions in different aspects of the process (definition of responsibility, measurement, control mechanisms, etc.).

5. Organizational structure adjustment

Generally, the organizational structure of growth-stage companies is built in segments, according to ad-hoc needs and manpower constraints, patched together to form one functioning system. This type of structure represents an evolutionary development of the company and does not support its strategy or successful and “smooth” implementation of work processes.

What to do

- Define your company’s strategic goals and main work processes

- Set an organizational structure based on suitable departmentalization (functional, regional, product, client, etc.) and define core responsibilities for each unit

- Formulate a comprehensive work-plan for transitioning to the new structure. Application and implementation can be done gradually, according to needs, constraints, and the time and pace needed.

Organizational structure that supports the strategic goals will help meet them in the most efficient way